san antonio property tax rate 2019

City of Alamo Heights. The effective tax rate for the city of San Antonio this year is 54266 cents per 100 valuation.

Tax Rates Bexar County Tx Official Website

The citys current tax rate which accounts for about 22 of property tax bills is nearly 056.

. Set by state law the homestead exemption for all Texas independent school districts currently is 25000. If your home is valued at 150000 and you qualify for a 25000 exemption you would only pay taxes on the home as if it were worth 125000. San Antonio TX 78205 Phone.

Alamo Community College District. Which Texas Mega City Has Adopted The Highest Property Tax Rate San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled Do You Need To Know More About Forbearance And Mortgage Relief Options Keeping Current Matters Mortgage Investment Advice Real Estate Tips. Maintenance Operations MO and Debt Service.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. Bruce Davidson 210-207-8998 brucedavidsonsanantoniogov Gabrielle Herrera 210-207-7069 gabrielleherrerasanantoniogov SAN ANTONIO April 26 2022 Delivering his annual State of the City address to business leaders today Mayor Ron Nirenberg said unemployment is down and property tax relief is coming for San Antonio residents. The citys revenues for 2022 is 21.

60 rows Discover what the 2019 tax rates and exemptions were. San antonio property tax rate 2019 Sunday May 8 2022 Edit. Monday-Friday 800 am - 445 pm.

Letter of Map. Skip to Main Content. 2019 Official Tax Rates Exemptions.

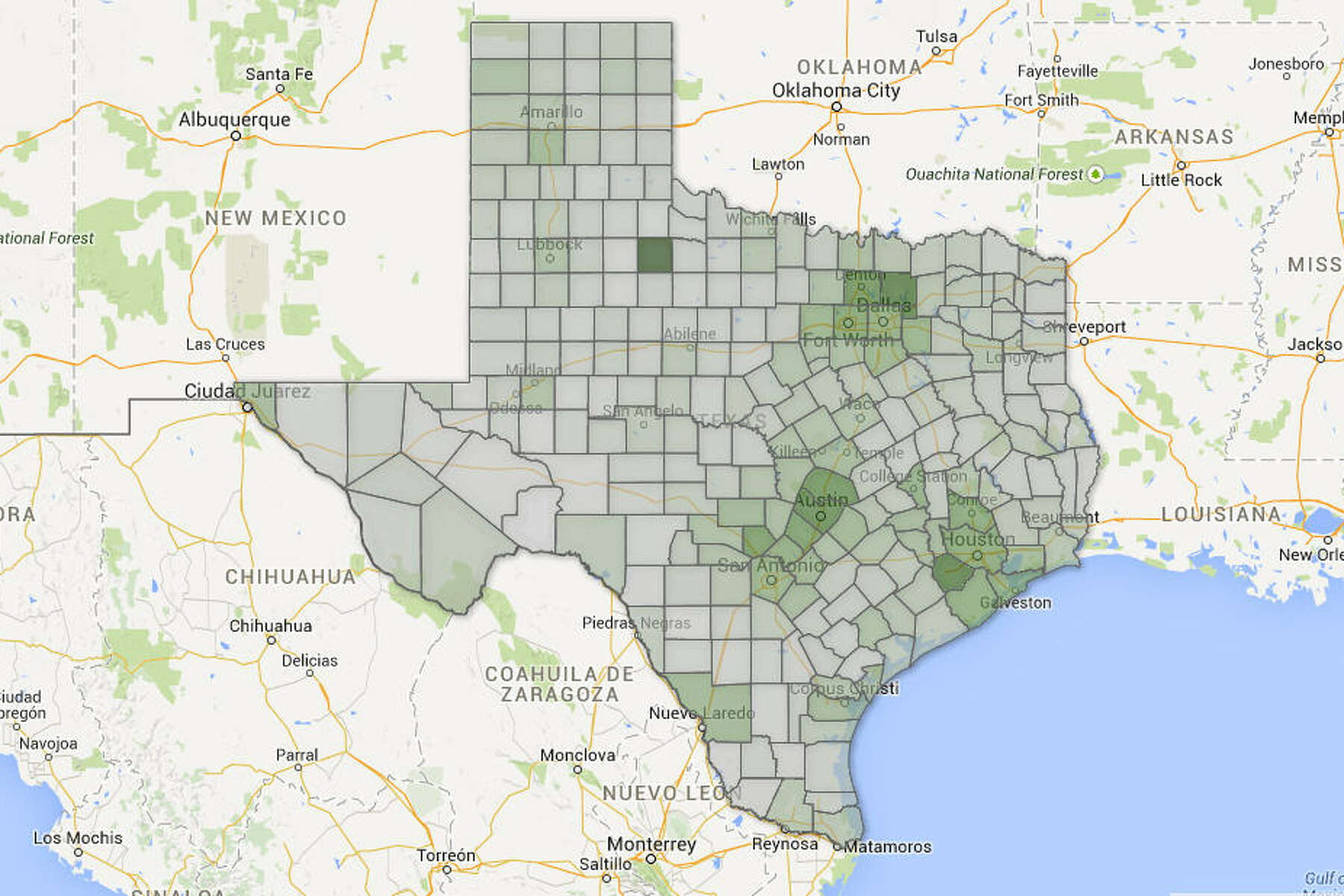

City of San Antonio. Anyone can apply for this Bexar County exemption for. Property Tax Per Capita 2019.

San Antonio TX 78231 210-495-0396 Schertz 3900 FM 3009 Suite 105 Schertz TX 78154 210-447-3750. San Antonio River Authority. The citys revenues for 2022 is 21.

Staff say the city has not raised the tax rate in 29 years and has lowered it seven times. School taxes typically are the major component of a homeowners annual property tax bill typically ranging from about 50 to 60 percent of the total. San Antonio TX 78207.

Sheridan San Antonio Texas 78204. Atascosa County Appraisal District 4th Avenue J Poteet Texas 78065 830 742-3591. Property Tax Per Capita 2019.

Setting tax rates appraising property worth and then receiving the tax. 2018 Official Tax Rates. The FY 2022 Debt Service tax.

Overall there are three phases to real estate taxation namely. Keeping in mind that san antonios city property tax rate is 55 per hundred dollars eliminating this line item could be huge and it is in many areas. Ad Research Is the First Step to Lowering Your Property Taxes.

Such As Deeds Liens Property Tax More. Property Tax Rate Calculation Worksheets by Jurisdiction. Bexar County lowered its tax rate last year to.

2018 Official Tax Rates Exemptions. Start Your Homeowner Search Today. 2019 Official Tax Rates.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. 48 rows San Antonio. Property Tax Per Capita 2019 PropertyTax per Capitaxlsx.

In the latest quarter it has been 247 which annualizes to a rate of 1024. 2019 official tax rates exemptions. Browse Current and Historical Documents Including County Property Assessments Taxes.

Taxing entities include San Antonio county governments and a number. 2019 Official Tax Rates. Wed 07312019 - 1445.

Public Sale of Property PDF. Box 839950 San Antonio TX 78283. Each unit then is given the tax it levied.

The property tax rate for the City of San Antonio consists of two components. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Digital Flood Insurance Rate Map.

14 rows City of San Antonio Print Mail Center Attn. Table of property tax rate information in Bexar County. Its currently set at 556 cents per 100 of valuation.

PersonDepartment 100 W. Alternatively the city could exceed the revenue cap but doing so would trigger an election asking voters permission to keep the additional tax revenue per the new law. Enter Your Address to Begin.

Road and Flood Control Fund. Ad Get In-Depth Property Tax Data In Minutes. Search Valuable Data On A Property.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. Truth in Taxation Summary PDF.

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Texas Property Taxes Among The Nation S Highest

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

Tac School Property Taxes By County

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Tac School Property Taxes By County

:watermark(cdn.texastribune.org/media/watermarks/2019.png,-0,30,0)/static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption