us japan tax treaty withholding rate

30 rather than 15. Tax benefits you get from treaties dont have to be claimed with Form 8833.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

25 0 15 or upon application as reduced by EU directivedouble tax treatydomestic law.

. See Internal Revenue Code sections 865h 904d6 and 904h10 and the regulations under those sections. Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same. On entitlement to treaty benefits.

Which countries have a double tax treaty with the USA. Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying. You must compute a separate foreign tax credit limitation for any such income for which you claim benefits under a treaty using a separate Form 1116 Foreign Tax Credit for each amount of resourced income from a treaty country.

This table should not be relied on to determine whether a US. However local law in some cases may provide a lower rate of tax irrespective of the. Tax treaties usually specify the same maximum rate of tax that may be imposed on some types of income.

The DTAA applies to the residents of the contracting states ie. Applicability of the agreement. For residents of non-EEOI regulated countries a final WHT at a 30 rate applies.

India and USA subject to certain exceptions. Before you run out and file this form talk to a Tax Advisor. The MIT withholding rate on income attributable to a trading business amounts from certain cross-staple arrangements and rents from agricultural land and certain residential housing is set at a rate equal to the top corporate tax rate ie.

By providing credit to the extent of tax already paid in the US The tax paid by Mr X in the US will be eligible for deduction in India. Ratification Was Advised by The Senate of The United States on November 29 1971. Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15.

As an example a treaty may provide that interest earned by a nonresident eligible for benefits under the treaty is taxed at no more than five percent 5. To claim it youd file Form 8833 and include your situation in the summary. The majority of USUK.

The rate has increased from 7 to 10 for 3 years from 1 August 2019 to 31 July 2022 after which the 7 rate will apply again. Withholding tax is chargeable for the following types of payments. When a person pays interest or fees in connection with a loan such as interest on late payments a withholding tax of 15 is chargeable on the payment.

The DTAA applies to the following taxes. IRS Publication 901 or the tax treaty document itself will tell you whether a US tax treaty with a particular country offers a reduced rate of income tax for nonresidents. Currently the US tax treaty network covers approximately 65 countries all over the world including.

Article 24 of the USUK. UNITED STATES - JAPAN INCOME TAX CONVENTION A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on March 8 1971. Withholding tax is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax.

Description of Withholding tax WHT rates. Tax treaty for example would help alleviate this particular situation. What are the Types of Payments Subject to Withholding Tax and their Tax Rate.

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

1 Income Tax Treaties Treaties With About 60 Countries All Major Trading Partners Totalization Agreements Agreements With 24 Countries Agenda For Class Ppt Download

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Form 8833 Tax Treaties Understanding Your Us Tax Return

U S Estate Tax For Canadians Manulife Investment Management

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

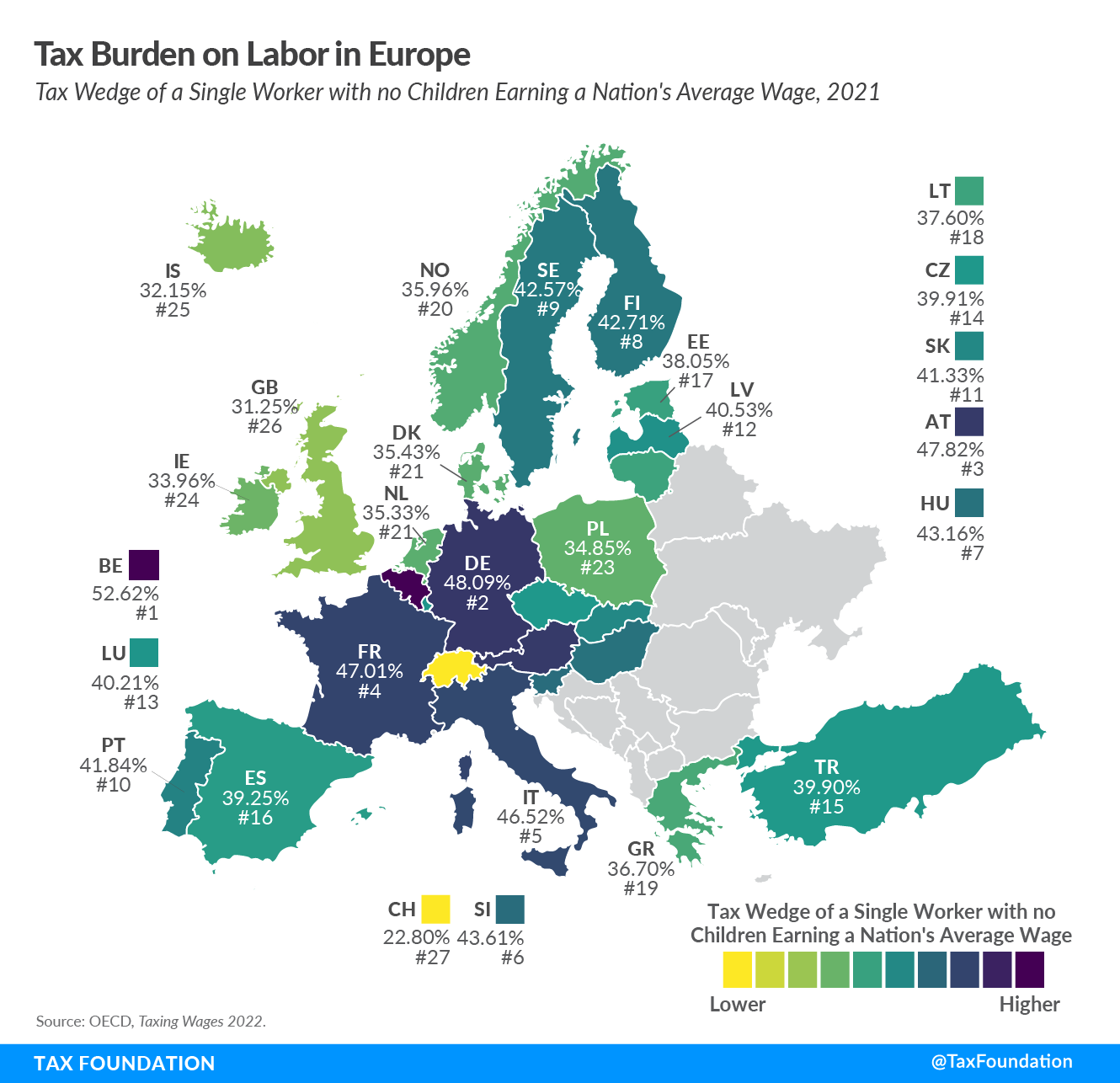

Portugal Tax Income Taxes In Portugal Tax Foundation

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Should The United States Terminate Its Tax Treaty With Russia

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology